In a recent decision by the Richmond Circuit Court, the court determined that the Va. Code § 8.01-380(C) does not allow recovery of defense witness fees for a nonsuit taken by the plaintiff at trial. What is most striking about the Richmond Circuit Court’s ruling is the lack of discretion for awarding fees at all if the nonsuit is taken during trial. This means, according to the Court’s ruling, a plaintiff can simply wait to take their first nonsuit at trial and it has virtually no risk of paying expert witness fees. In light of this ruling, plaintiffs are afforded the opportunity to literally settle the case “on the court house steps” without the Va. Code § 8.01-380(C) fee provision hanging over their heads.

In a recent decision by the Richmond Circuit Court, the court determined that the Va. Code § 8.01-380(C) does not allow recovery of defense witness fees for a nonsuit taken by the plaintiff at trial. What is most striking about the Richmond Circuit Court’s ruling is the lack of discretion for awarding fees at all if the nonsuit is taken during trial. This means, according to the Court’s ruling, a plaintiff can simply wait to take their first nonsuit at trial and it has virtually no risk of paying expert witness fees. In light of this ruling, plaintiffs are afforded the opportunity to literally settle the case “on the court house steps” without the Va. Code § 8.01-380(C) fee provision hanging over their heads.

Va. Code § 8.01-380(C) reads:

C. If notice to take a nonsuit of right is given to the opposing party within seven days of trial, the court in its discretion may assess against the nonsuiting party reasonable witness fees and travel costs of expert witnesses scheduled to appear at trial, which are actually incurred by the opposing party solely by reason of the failure to give notice at least seven days prior to trial. The court shall have the authority to determine the reasonableness of expert witness fees and travel costs.

No Nonsuit After Defective Signature

In a recent Norfolk Circuit Court case the judge ruled that a lawyer’s missing signature from the Complaint prevented them from taking a nonsuit, since the defective Complaint was not a “validly pending proceeding.” In this particular case, the the plaintiff’s signature appeared on the Complaint, but the attorney’s signature was not endorsed above their printed name.

This recent ruling is a poignant reminder for those Virginia subrogation attorneys and other plaintiff attorneys that any defective complaint can jeopardize a nonsuit. The strategic value of a nonsuit, the peculiar remedy in Virginia allowing the plaintiff to dismiss a claim voluntarily and thereby toll the statute of limitations by six months, cannot be overstated. When a case like this comes along it reinforces the need for close scrutiny of all pleadings, but especially complaints, as an innocent error can result in a statute of limitations problem and future bar complaints and ethics litigation.

Richmond Collection Attorney

The law firm of Chaplin & Gonet has been serving businesses and individuals by collecting on delinquent accounts for nearly twenty years. If you or your business is looking for a Richmond Collection Attorney then give our office a call and learn how we can help you collect on those delinquent accounts taking up your business’ valuable time.

Our firm is proud of our long history in the Richmond area, but our firm has more to offer than history. Striving to serve our clients better than any other Richmond Collection Attorney, we use state-of-the-art collection practices and communications processes to track and maintain files while keeping our clients abreast of any developments.

One of the defining characteristics of Chaplin & Gonet is our statewide claims coverage, which allows us to pursue clients’ delinquent accounts throughout the state. This is something few, if any, other Richmond Collection Attorneys can boast. There is no need to worry about having to refer business to different firms depending on where in the state the accounts arose. Chaplin & Gonet can truly be your first and last word for Richmond Collections.

Contact our office today to learn more about how Chaplin & Gonet can help your business.

Debt Collection in Virginia

Many Virginia business owners or employees tasked with tracking delinquent accounts run into the problem of the account far past due and ask themselves “what now?” The debt collection process in Virginia is unique and this post seeks to give a brief overview for those Virginia business owners faced with tackling debt collection.

Many Virginia business owners or employees tasked with tracking delinquent accounts run into the problem of the account far past due and ask themselves “what now?” The debt collection process in Virginia is unique and this post seeks to give a brief overview for those Virginia business owners faced with tackling debt collection.

First, most debts are accrued under a contract, whether it be for the financing of a car, purchase of goods or services, or medical care. The controlling contract should have provisions governing what happens if an account is overdue. For instance, imposing late fees, accelerating the rest of what’s owed, or any other remedies under the contract. Often, it is beneficial for the creditor to reach out to the debtor to ascertain the debtor’s situation and seek to set-up payment arrangements if the entire amount owed cannot be made at present. Unfortunately, this all takes time. Debt collection is a time consuming, and often frustrating, process. At Chaplin & Gonet we have a team of experienced, courteous debt collection representatives who can manage your past due accounts. This leaves our clients with more time to concentrate on building their business and keeping their clients happy.

If working with the debtor to set-up payment arrangements does not work, then legal action is usually the next step. This debt collection practice is, of course, one that is most preferably done by an experienced debt collection attorney. At Chaplin & Gonet our experienced litigation and collection attorneys regularly appear in court all over Virginia and can handle virtually any debt collection matter. In Virginia, one usually files a Warrant in Debt in General District Court to assert the accrual of debt and allege that it is owed under a contract. This step of the debt collection process will oftentimes lead to the debtor contacting our office and setting-up payment arrangements. However, sometimes the matter goes forward and a trial is required. Having a team of experienced debt collection attorneys on your side is crucial at this juncture. The attorneys at Chaplin & Gonet are all experienced litigators that know the law and will strive to represent your interests with zeal in court.

If your business is in need of collecting on past due accounts call our office today to speak to a representative about making Chaplin & Gonet part of your debt collection team.

How to Choose a Debt Collector

For most small business owners the main area of concern is attracting and maintaining clients or customers. Not much thought or planning is usually given to how to collect on accounts receivable that are past due. This is understandable. Most of us operate on the assumption that people and businesses pay their debts on time, however, as any seasoned business owner can attest to, that is not always the case. This post will point out some important considerations to weigh when choosing a debt collector for your business, whether it is big or small, the attributes required for a competent debt collector are the same.

For most small business owners the main area of concern is attracting and maintaining clients or customers. Not much thought or planning is usually given to how to collect on accounts receivable that are past due. This is understandable. Most of us operate on the assumption that people and businesses pay their debts on time, however, as any seasoned business owner can attest to, that is not always the case. This post will point out some important considerations to weigh when choosing a debt collector for your business, whether it is big or small, the attributes required for a competent debt collector are the same.

1. Will Your Debt Collector Travel?

This seems like a strange question at first blush, but it is an important consideration. For instance, if you have a business that deals with clients across Virginia you may not want to choose a debt collector who only appears in Richmond-area courts. Since many cases are filed where the defendant is located your debt collector would not be able to appear at any court proceedings outside of their geographic practice area. For instance, at Chaplin & Gonet, we travel across Virginia for subrogation and collection cases. This means that for clients looking for a debt collector that can handle both local and intrastate cases, we would likely be good candidate. Regardless of where you are, know what type of clients your business will be dealing with, and where they will most likely be located, and discuss this with your prospective debt collector.

- Debt Collector Capacity

Debt collection practices require specialized infrastructure that other types of practices do not. Since files require constant monitoring, from the intake of files to filing Warrants in Debt and trials, your debt collector should have a well-trained, experienced staff to help care for your accounts and ensure that nothing slips through the cracks. At Chaplin & Gonet we have a team of dedicated debt collectors, support staff and attorneys that work in concert to maximize the return for our clients.

- What Type of Claims Can Your Debt Collector Handle?

What type of accounts you have delinquent should also affect who you choose as your debt collector. For instance, if you are a medical provider then your claims are mostly contract claims. However, if you are a large apartment complex, then your claims can range from a simple contract claim to having to evict tenants and sue for damages to the units. Having a debt collector that has experience and expertise in your business area is an important consideration. At Chaplin & Gonet we have handled thousands of accounts ranging from automobile subrogation to healthcare collection cases. Our attorneys and debt collectors have most likely helped a client with similar needs as yours and we can start working with you immediately.

Interview with Carrier is Protected Work Product

A recent ruling by the Prince William County Circuit Court declared that interviews by carriers with their insured regarding an auto accident fall within the shield provided by the “work product” doctrine of supreme Court Rule 4:1(b)(3). The Virginia Court of Appeals upheld the decision. Plaintiff’s motion to compel was denied for several reasons.

A recent ruling by the Prince William County Circuit Court declared that interviews by carriers with their insured regarding an auto accident fall within the shield provided by the “work product” doctrine of supreme Court Rule 4:1(b)(3). The Virginia Court of Appeals upheld the decision. Plaintiff’s motion to compel was denied for several reasons.

First, the court stated that the “work product” doctrine “protect[s] not only materials gathered by or for counsel in anticipation of litigation, but materials gathered by or for others, including the liability insurance carrier.” Furthermore, the court cited Veney v. Duke for the proposition that discussions of third party coverage is protected by the “work product” doctrine, and extended that logic to discussions of first party coverage. Finally, since the case at bar involved an insured who plead guilty to a traffic infraction and contested liability in a subsequent civil case, the court stated that the affirmative duty of defense counsel to prevent his client from testifying to a known falsehoods “offers sufficient protections.”

This ruling has important ramifications for Virginia subrogation attorneys, insurance defense firms and personal injury attorneys. For the Virginia subrogation attorney, this ruling confirms an intuition long held, that those conversations by insurance adjusters regarding third party coverage should be protected under Virginia’s “work product” doctrine. Insurance defense firms facing Virginia subrogation firms should expect to be stymied by this latest ruling when issuing subpoenas duces tecums in the future.

Justin McLeod

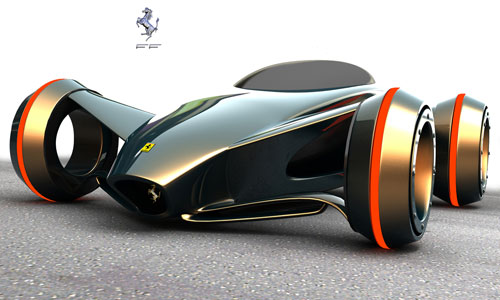

What is an Autonomous Vehicle?

Several states who are currently in the process of enacting, or who have enacted, legislation paving the way for testing autonomous vehicles have all grappled with defining “autonomous vehicles.” Virtually all states embarking down the path to vehicular autonomy defined autonomous vehicles in the same way: “a motor vehicle that uses artificial intelligence, sensors and global positioning system coordinates to drive itself without the active intervention of a human operator.” See 2012 Okla. Sess. Laws 3007; 2012 Haw. Sess. Laws 2238; 2012 Ariz. Sess. Laws 2679; 43 Nev. Rev. Stat. § 482A.030. See also 2012 N.J. Laws 3020 (New Jersey has adopted similar language, except for using: “or any other technology to carry out the mechanical operations of driving without the active control and continuous monitoring of a human operator” instead of “without the active intervention of a human operator”). California’s legislators chose to define “autonomous technology” as the technology that has the capability to drive a vehicle without the “active physical control or monitoring by a human operator.” 2012 Cal. Stat. 1298 c. 570. California Senate Bill No. 1298 goes on to define an “autonomous vehicle” as any vehicle “equipped with autonomous technology that has been integrated into that vehicle.” Id. So far, all states agree that autonomous vehicles are just that, autonomous, in that they do not require “active” participation or control by the human “operator.” However, time will tell how the definition of “autonomy” crystallizes as legislatures across the country put in place rules and regulations governing the day-to-day operation of autonomous vehicles.

Virginia Texting Law May Need Tweaking

A case in Fairfax General District Court, heard before Judge Thomas E. Gallahue, underscores the need for the Virginia General Assembly to overhaul the Reckless Driving code section to explicitly include texting while driving. In the case Judge Gallahue dismissed the reckless driving charge against Jason Gage since the statute in question, VA Code section 46.2-852 et seq. This issue directly affects Virginia Subrogation attorneys, who routinely use the convictions or pleas of guilt to driving offenses as evidence in the case against defendant drivers.

A case in Fairfax General District Court, heard before Judge Thomas E. Gallahue, underscores the need for the Virginia General Assembly to overhaul the Reckless Driving code section to explicitly include texting while driving. In the case Judge Gallahue dismissed the reckless driving charge against Jason Gage since the statute in question, VA Code section 46.2-852 et seq. This issue directly affects Virginia Subrogation attorneys, who routinely use the convictions or pleas of guilt to driving offenses as evidence in the case against defendant drivers.

The case in question arose from Jason Gage allegedly reading texts while driving, according to Gage’s cellular records, which show he received several text messages around the time of the accident. Kyle Alec Rowley, only 19 years of age, was fatally struck by Gage’s car when his car was parked in the right travel lane after ceasing to operate. Rowley’s hazard lights were illuminated and the car in front of Gage successfully navigated around Rowley’s vehicle, but Gage struck the rear of Rowley’s vehicle, killing Rowley.

According to police there were no signs of excessive speed or driving under the influence to account for Gage’s accident, which led them to investigate his cellular records. The police did not think to charge Gage under VA Code 46.2-1078.1, which levies a $20 fine for texting while driving. Since the reckless driving statutes do not include provisions proclaiming texting or talking on a cell phone “reckless” Judge Gallahue stated he had to dismiss the charge.

There is a strong argument that amending the reckless driving statutes to include a provision for texting while driving will send a strong message to Virginia drivers to cease texting while driving. There have been numerous studies demonstrating texting while driving exponentially increases the likelihood of an accident. For the Virginia Subrogation attorney having a clearly written, inclusive reckless driving statute makes prosecuting subrogation claims easier to prove in court, since a conviction or admission would demonstrate prima facie negligence on the part of the defendant.

Virginia Subrogation Referrals

If your law firm handles insurance defense or subrogation anywhere in the United States Chaplin & Gonet can help you and your clients meet your Virginia subrogation needs. Meeting national subrogation demands have never been easier with the help of Chaplin & Gonet. Contact our office today to speak to a representative about referring Virginia subrogation cases to Virginia’s trusted name in subrogation litigation: Chaplin & Gonet.

A Lawyer's Mistake Not A Fair Debt Act Violation

An Alexandria, Virginia, lawyer was protected from a Fair Debt Collection Practices Act violation suit by alleging a “bona fide error defense” in claiming attorney fees under an expired contract. The nursing home contract had expired by the time the attorney claimed his attorney fees, though upon discovering this fact he sought to amend his suit. The ruling in McLean v. Ray comes down in an unpublished opinion of the 4th U.S. Circuit Court of Appeal that looked to similar language in an earlier opinion examining the same legal defense under the Fair Debt Act.

An Alexandria, Virginia, lawyer was protected from a Fair Debt Collection Practices Act violation suit by alleging a “bona fide error defense” in claiming attorney fees under an expired contract. The nursing home contract had expired by the time the attorney claimed his attorney fees, though upon discovering this fact he sought to amend his suit. The ruling in McLean v. Ray comes down in an unpublished opinion of the 4th U.S. Circuit Court of Appeal that looked to similar language in an earlier opinion examining the same legal defense under the Fair Debt Act.

The nursing home patient, Edith McLean, had left the nursing home for a 20-month period, allowing the contract to lapse. The debtors, Edith’s son James and his wife, claimed lawyer Ronald A. Ray should have been quicker to catch the error. The appeal court found that he had been “diligent in investigating the matter” and removed the claim “as soon as he was able to confirm the contract no longer applied.” For debt collection attorneys the most educational aspect of this episode is the prism through which the appeal council viewed Ray’s behavior:

“At bottom, our inquiry focuses on whether the procedures Ray employed were reasonably adapted to avoid error. We are satisfied that they were, and that Ray is thus entitled to the benefit of the bona fide error defense,” wrote Judge Albert Diaz for the panel.